The Game

This is generally how the game goes. Volume bequeaths power. In the tea trade, it’s both buying and selling power.

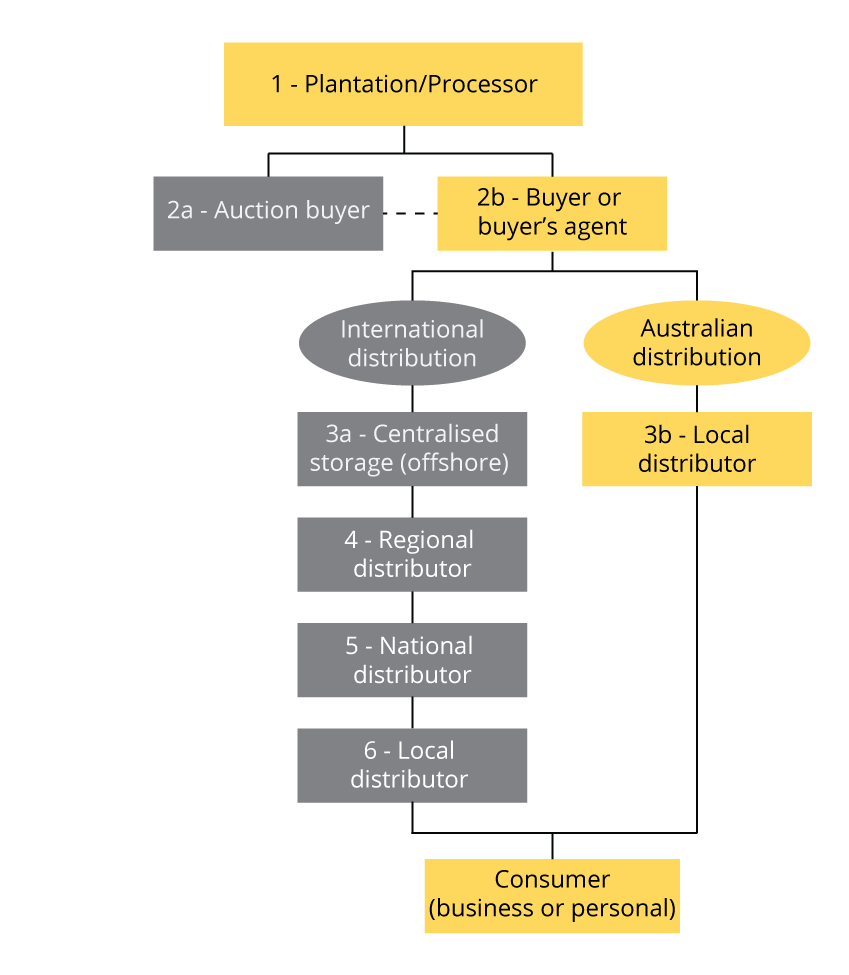

Sometimes this is perverse but sometimes it isn’t. It’s a raw deal for the growers when it’s a buyers’ market. Multinationals with mega volume (hundreds or thousands of tonnes) purchasing power can force a low price at auction or on plantations directly (or on the cost of labour if they own the plantations). Producers yield when there’s a reliance on exports, a contractual agreement or there are no other significant buyers – this could likely lead to an unfair trade. It can happen especially in former colonial states (e.g. India, Sri Lanka) where tea is often treated as a trade commodity to be produced en masse, where quality is not always the highest priority. If you refer to our flowchart, this kind of scenario can happen particularly down the grey-coloured route on the left side.

You’ll notice the grey route has a fair few more middle-men. And since every link in the chain wants to make a profit, you can imagine the price squeeze at origin. You can also imagine the low incentive for quality from the start, let alone the potential for deterioration as the product gets passed from one link to another.

So obviously we avoid this path. In fact, it was one of the reasons why Tea Craft got started.

But the game’s changed over the years. And if we were to sum up this change with one word, it’d be CHINA.

When the grower calls the shots

China has flipped the tea importation game on its head. In many instances, the producers here call the shots. They’re the ones who demand you to buy volume. This is not because they can’t get rid of the stuff, it’s largely because they don’t want you to waste their time on incremental administration and logistics. They’re forcing buyers to be more efficient and inarguably, that can be good for everyone in the chain.

Why are some growers or manufacturers able to do this? There are many reasons. To name a few firstly, domestic demand for tea in China is big enough. They don’t necessarily need export dollars. In cities with populations commonly in the millions, how are Aussie tea companies with their piddly consumer numbers going to hold any sway? Another reason is that for many teas, quality (whether actual or perceived) drives demand. This demand often outstrips supply. Broader socio-economic factors also contribute to the tea producers’ power. Rises in standard of living and currency value for example means that their income expectations have risen and importers must adapt.

Are you an origin-romanticiser?

When volume motivates both economic and environmental efficiencies and does not adversely affect product quality, it doesn’t matter so much where you fall in the chain so long as it’s appropriate to the level of demand being fulfilled.

Because Australia is such a small market relative to the world, most tea suppliers need to carry a diverse enough range to appeal to enough of what’s already a limited audience. And if each tea type comes from a specific region in a specific country, that Aussie company’s purchasing power dwindles to complete insignificance. Now if consumers indiscriminately insist that suppliers must always procure from origin, how would little local companies be able to sustainably buy direct with their wee-wee invoice? They’d be paying retail (if the supplier is even willing to sell to them) and think of the environmental footprint. Here, nobody wins. The producer will get their cash but needs to put up with additional inefficiencies. The local Aussie importer has to pay a premium, which inevitably gets passed onto you, the consumer. The atmosphere cops a few more wafts of carbon monoxide.

Especially for many of our Chinese, Japanese and organic Indian sub-continental teas, we’re lucky enough to have either the volume, personal connection or travel opportunity to buy from source (box 1). Where it proves more efficient though, sometimes we also buy from a trusted in-country buyer (box 2b) who specialise in particular tea regions.

In other words, sometimes Tea Craft is 2b and sometimes we’re 3b (and through Tjok’s cheeky Balinese tea plot, we’re even 1 but that’s a stretch).

The game needs to be told to improve education and transparency. Armed with this info, you can question those that seem to claim origin buyer (2b) status too readily and indiscriminately. You can challenge your own presumptions about whether buying from source is always the best for every situation. If you find your supplier falls in 2a, 4, 5 or 6, you may like to assess whether the quality of product and product information is sufficient.

The tea game like most things is not a one-size fits all deal. It can be complex but certainly not incomprehensible. Knowing what to look or ask for makes it easier to digest its true intricacies.